The US economy began 2024 on a milder note than expected as raised expansion and loan costs kept on burdening the economy. While we don't conjecture a downturn in 2024, we really do expect customer spending development to cool further and for generally speaking Gross domestic product development to ease back to under 1% over the Q2 to Q3 2024 period.

From that point, expansion ought to slowly standardize to the Federal Reserve's 2-percent focus in 2025 as quarterly annualized Gross domestic product development increases toward its capability of close to 2%.Interest rates ought to fall beginning in late 2024 yet may settle at levels surpassing the pre-pandemic normal.

US shopper spending held up strikingly well in 2023 regardless of various headwinds. In any case, this pattern has started to disappear. Genuine retails deals development is in retreat and customer certainty has succumbed to a while.

Gains in genuine expendable individual pay development are mellowing, pandemic reserve funds have been depleted, and family obligation is expanding quickly. Buyers are spending a greater amount of their pay to support obligation and vehicle credit and Visa misconducts are rising rapidly.

Consequently, we conjecture that general buyer spending development will keep on easing back in Q2 and Q3 2024 as families battle to track down another balance between pay, obligation, reserve funds, and spending.

The work market stays strong. Regularly scheduled finance acquires eased back in April, with businesses adding 175,000 positions. In any case, bosses added a normal of 242,000 positions in the three months finished in April, and the joblessness rate stayed under 4% last month.

The inventory of laborers and the interest for work keep on coming into better equilibrium. The workforce cooperation pace of people matured 25 to 54 is currently higher than before the pandemic started, as displayed in figure 1.

Businesses' requirement for laborers, as estimated by employment opportunities, declined 12% from a year sooner, as displayed in figure 2. This rebalancing of the work market has brought about ostensible compensation development facilitating even as joblessness remains generally low.

Inflation

Obviously, I have been watching out for expansion. Fortunately expansion has facilitated decisively from the pinnacle arrived at very nearly a long time back, as displayed in figure 3. Be that as it may, expansion stays over the Government Open Market Panel's (FOMC) 2% expansion objective.

Center individual utilization consumptions (PCE) costs, which prohibit unstable food and energy costs, rose at a quicker pace over the initial three months of the year than they did in the last option part of 2023. The April buyer cost file and maker cost record information highlight a more humble increment last month.

All things being equal, Central bank staff gauge that center PCE costs increased at a yearly pace of 4.1 percent over the initial four months of the year. That is well over the year change, which we gauge at 2.75 percent. It is too soon to tell whether the new stoppage in the disinflationary cycle will long endure. The better perusing for April is empowering.

Luckily, information on assumptions recommend that the FOMC's expansion battling believability stays in salvageable shape. While there has been a new increase in Americans' expansion assumptions throughout the following a year, long haul expansion assumptions, over the course of the following 10 years, stay near pre-pandemic levels.

That shows the American public accept that we will follow through with our obligation to take expansion completely back to our goal. I'm keenly conscious that high expansion forces huge difficulty as it disintegrates buying power.

Particularly for those on fixed salaries and those most un-ready to meet the greater expenses of basics, including lodging, transportation, and food. For that reason my partners at the Fed and I are so dedicated to returning expansion to our objective.

All in all, how might the present status of the economy affect the arrangement rate we set at the Fed? At the latest gathering, three weeks prior, my associates and I on the FOMC chose to keep up with the objective reach for the government finances rate at 5-1/4 to 5-1/2 percent.

I accept that our approach rate is an in prohibitive area as we keep on seeing the work market come into better equilibrium, and expansion decline albeit not even close as fast as I would have loved.

The FOMC noticed that it doesn't expect it will be fitting to lessen the objective reach until it has acquired more noteworthy certainty that expansion is moving reasonably toward 2%.

In making decisions about the suitable position of strategy rate after some time, I will be cautiously surveying the approaching information, the developing standpoint, and the equilibrium of dangers.

At its last gathering, the FOMC likewise chose to proceed with the most common way of decreasing our monetary record, however at a more slow speed. The cap on Depository reclamations will be brought down from the current $60 billion every month to $25 billion every month as of June 1.

Steady with the Board of trustees' expectation to hold basically Depository protections in the more extended run, we're leaving the cap on organization protections recoveries unaltered at $35 billion every month. We will reinvest any returns in abundance of this cap in Depository protections, as nitty gritty in the May 1, 2024 working strategy articulation distributed by the Central Bank of New York.

The Fed sets strategy to advance its double order targets of greatest business and value solidness, and work and expansion rely upon conditions in the whole economy. In any case, given our social occasion today, I figured it would be proper to plunge a piece further into the lodging and home money markets.

As I said before, the lodging area is one of the most financing cost delicate pieces of the economy. We have seen that awareness in contract rates and home loan starts.

As displayed in figure 4, 30-year fixed-rate contract rates were near 3% when the government subsidizes rate was close to the zero lower bound in 2020 and 2021. Rates flooded in 2022 as the government supports rate expanded. Steady with the expansion in contract rates, contract beginning volume has fallen fundamentally.

The ongoing prohibitive position of money related approach has burdened the real estate market. That is assisting with bringing organic market into better equilibrium and put descending squeeze on expansion. One part of expansion that has stood out enough to be noticed is lodging and rental expenses.

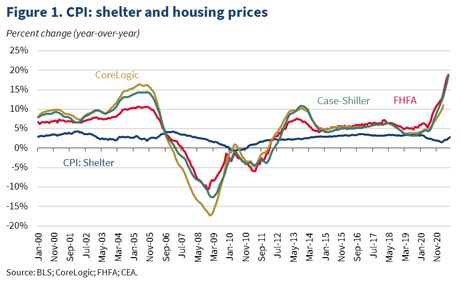

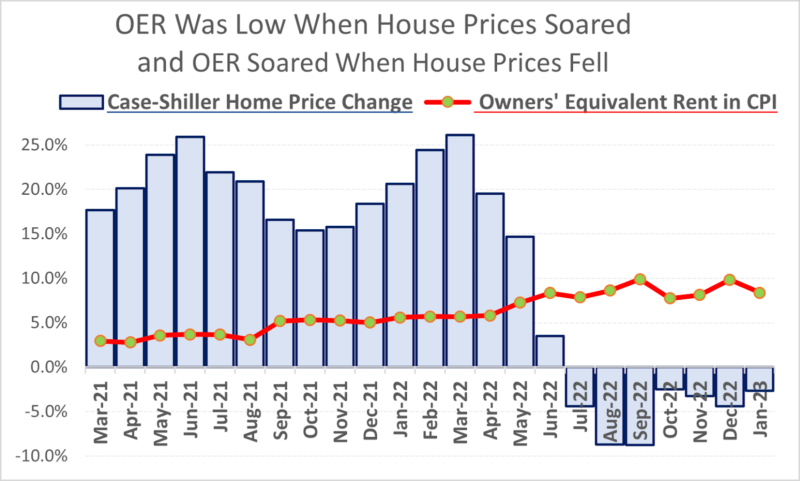

This is on the grounds that lodging costs make up such a huge portion of family financial plans. To work out lodging administrations expansion, government insights don't utilize home costs in light of the fact that a house is part of the way a venture.

All things considered, lodging administrations expansion is registered utilizing month to month leases that catch what occupants pay to lease a house or condo and what property holders would, in principle, pay to lease their own home.

The way this computation is determined means changes in market rents or what another occupant pays to lease consume a large chunk of the day to go through to PCE lodging administrations costs, as displayed in figure 5.

Here, notice that expansions in market leases, the blue and red lines, topped in 2022, and PCE lodging administrations expansion, the dark line, slacked market leases and crested in 2023.

The essential justification behind this slack is that market rents change more rapidly to financial circumstances than what property managers charge their current inhabitants.

This slack recommends that the enormous expansion in market rents during the pandemic is as yet being gone through to existing rents and may continue to house administrations expansion raised for some time longer. This perception is significant on the grounds that it is an illustration of one of the fundamental wellsprings of slacks with which financial arrangement influences expansion.

Another component influencing go through of prohibitive financial arrangement is that fixed-rate contracts are normal in the U.S. It is in many cases contended that this credit structure hoses the impact of financial approach. Figure 6 shows that the 30-year fixed contract rate is around 7%, while the typical extraordinary home loan rate is around 4%.

This lower extraordinary home loan rate is because of families who secured in rates during lower-premium periods, including when the Fed cut the objective reach for the government supports rate to approach zero not long after the pandemic grabbed hold. Fixed-rate contracts in all actuality do hose the impact of financial approach, however, as per ongoing examination, not generally so much as beforehand thought.3

There is a deferral between when home loan rates go up and when family contract installments go up, as displayed in figure 7. Load up staff research reports that contract installments go up over the long haul in light of the fact that numerous families keep on renegotiating their home loan or move.

Notwithstanding higher rates, families in the U.S. acquired more than $1.5 trillion in new home loan credits in 2023. These borrowers incorporate first-time homebuyers, existing property holders moving among homes, and property holders acquiring cash-out renegotiates.

The installment they owe on that as of late acquired contract is higher than it would have been had lower rates been kept up with, and their utilization might be correspondingly lower.

The combined impact of a higher financing cost on total home loan installments develops over the long haul as additional new credits are begun at the higher rate. That's what the staff's exploration reports, by and large, borrowers like these who are not dissuaded by higher rates are answerable for somewhat over portion of the pass-through of loan fees to contract installments.

All things considered, let me repeat why we care about lodging. The lodging area is where numerous families have made, or will make, their biggest speculation. Subsequently, the costs that families pay for that lodging can influence their general prosperity. The work you do to make lodging open is a significant piece of the economy.

The lodging area is likewise a vital piece of the transmission instrument of money related strategy. That is one motivation behind why policymakers will keep on giving close consideration to this essential area. Obviously, nobody area directs money related approach.