In July, we are talking about insurance digital transformation and digital transformation. As you know, digital transformation is the most common way of integrating digital technology innovations into all regions of a business, including items, administrations, and tasks. It can, on a very basic level, change how a business works and conveys worth to clients, and it is likewise a social change that expects associations to ceaselessly rock the boat.

To win in the present swarmed and hyper-cutthroat protection market requires speed, effectiveness, and convenience. That implies going computerized, and however, this is definitely not a straightforward cycle. By utilizing a shrewd procedure, each step will draw you closer to receiving the rewards of computerized change.

The stunt isn't to get overpowered; you don't need to make the progress across the board in singular motion. Think about computerized change as an excursion instead of simply an objective, and gather the advantages en route. Here is our manual for insurance digital transformation and how you can convey these new capacities to your clients.

By and large, the protection business has been famously slow in its reception of new advances. The thoughts of streamlining work processes, moving to a web-based connection point, or, in any event, handling claims same-day once appeared to be unthinkable. That is, until the overall computerized change, everything being equal, and presently the digital transformation of insurance.

For safety net providers, advanced change is "the most common way of utilizing computerized innovations to make new or alter existing cycles, societies, and client encounters to meet changing business and market necessities. This reconsideration of business in the advanced age is a computerized change.

Today, it is typical for property and loss safety net providers to deal with a larger part of their business on the web or through computerized applications. The present buyers just want interest speed; they need instant satisfaction, and on account of insurance, that implies quick contract statements, charge installments, and correspondence.

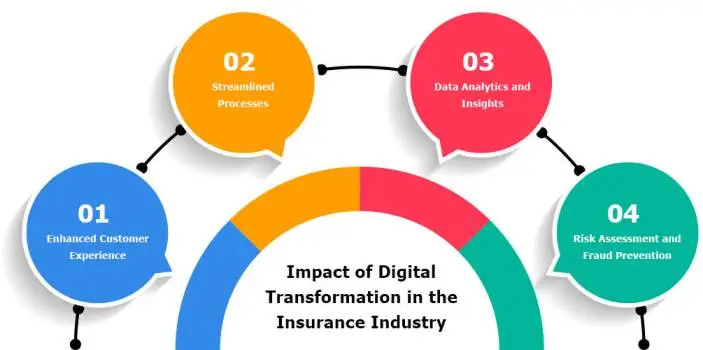

Where the digital transformation of insurance will go in what's to come is generally obscure. Be that as it may, specialists accept the greatest effects will be felt across claims handling and guaranteeing, fueled by new improvements in man-made brainpower (man-made intelligence) and the Web of Things (IoT). These devices, and that's just the beginning, are essential for the course of the present protection of computerized change.

As we have referenced previously, client assumptions are generally driving advancement and the digital transformation in insurance. Furthermore, when we allude to the client confronting or client-influencing elements of protection, we are alluding to what is known as the protection esteem chain. Today, digitizing and overhauling the protection esteem chain is a higher priority than at any time in recent memory.

However, what is the protection-esteem chain? The protection esteem chain incorporates every one of the parts of protection that organizations produce esteem from. Consider all the touchpoints across which transporters and clients cooperate.

Those associations additionally encompass client self-administration capabilities, which are critical to the present customer. At the point when we talk about the protection-esteem chain, we are alluding to:

1: Item the board, 2: Deals and circulation, 3: New business guaranteeing, 4: Cases, 5: Installments; 6: Client Assistance

The instruments and applications that include advanced protection, digital insurance AI, prescient examination, large information, and cloud-based administrations have started protection computerized change. And keeping in mind that these devices are essential, the course of computerized change includes significantly more than basically putting in new programming.

For transporters that have an intricate blend of inheritance IT frameworks, handling these computerized refreshes and carrying out new frameworks can appear to be overwhelming, costly, and unsafe.

Yet, have no trepidation; a cloud-based foundation permits you to take a little, multi-staged way to deal with your computerized change at your own speed. For instance, begin by picking one line of business to deal with and searching for arrangements that empower you to assemble and bring together all of your information in one spot.

Regardless of where you start, one fundamentally significant element to consider all through your computerized change is your innovation's capacity to refresh and stay current consistently.

With arrangements that are evergreen, you can encounter limitless advancement fueled by present-day, deployable innovation that is consistently current and consistently capable. This is the focal advantage of computerized innovation in protection; it engages you to find new essential answers for your clients before they even realize they need them.

Today! In this blog, you can find the best information about digital transformation services and digital enterprise transformation solutions. It can take time, but regardless of whether you're hoping to make a computerized change at the same time, there are a couple of reliable advances you ought to take to make this interaction as smooth as could really be expected.

The criticality of enterprise transformation is unquestionable. Interruption isn't new, yet the speed of progress is speeding up. New serious dangers, quickly propelling innovation, the effect of the pandemic, and an expanded consciousness of supportability are pushing organizations to change, to remain cutthroat, to make due, and to develop.

We get change going. We assist clients with adjusting to be more dexterous, strong, important, and feasible. Accomplishing this request requires a reason-driven system, improved, information-driven business processes, an emphasis on worker experience, smart HR, and culture, and an empowering innovation scene.

Business Now News Concoct conveys extensive enterprise transformation solutions. We influence a special mix of technique, cycle, individuals, and innovation mastery, joined with the force of information, to convey your start-to-finish change. We extend your computerized impression and drive manageable business development.

The primary stage on the excursion to protection against advanced change is the robotization of current cycles. Shoppers today expect elevated degrees of speed and customized consideration, which would be almost inconceivable without mechanized capabilities. There are genuine additions to be made here, and numerous tasks in the protection business can be made more proficient and compelling with advanced advancements and strategies, for example,

1: Robotizing endorsing rules and driving references through more proficient work process processes; 2: Naturally opening cases, inclusion, and setting saves in light of pre-characterized rule sets; 3: Executing live visit capabilities and consequently responding to client different kinds of feedback progressively; 4: Computerizing charging and correspondences.

The second phase of a backup plan's computerized development is that of improving key concentrations. A stage past mechanization of errands, this stage centers around distinguishing basic components that separate transporters in the commercial center and utilizing computerized advancements and systems to enhance processes that help those market objectives.

The third, and generally created, phase of computerized development is the finished, start-to-finish change of a business to an open, associated "stage" model. Now and again alluded to as "environments," stage organizations, similar to Amazon and eBay, are coordinated to meet advancing business sector needs by arranging associations between purchasers, merchants, items, information, and specialist co-ops all in an open, educated, iterative, and dynamic pattern of organic market.

While this degree of improvement plainly requires broad, advanced underpinnings to work, the model requires more than innovation alone. It requires a better approach to thinking and working and addresses the total change in a safety net provider's association and go-to-showcase procedure.

The gap between safety net providers that are carefully empowered and those that are not is speeding up. It's at this point not whether or not to supplant inheritance center frameworks; it's about how.

Numerous safety net providers, particularly little-to-medium transporters and those with more modest pools of tech ability to draw from, are successfully jumping the opposition by progressing to a product-as-a help (SaaS) model for their center frameworks.

Computerized change is presently prepared into clients' assumptions. In "The 2016 Province of Computerized Change," Altimeter overviewed 528 advanced change pioneers and tacticians across ventures and requested that they rank the needs driving their advanced change projects.

The ramifications are that advanced change is being driven more by worries around income, maintenance, and client experience than by innovation. The advanced change of protection at its best brings hindrances down to their passage. It's simple for end clients to embrace and adjust by means of setup, not code. Furthermore, through the cloud, IT is presently accessible as a functional cost as opposed to a capital cost.

Due to pre-reconciliations and the always prepared and consistently refreshed territory of SaaS stages, guarantors can promptly involve and profit from greater usefulness for computerized interchanges, information-driven independent direction, and prescient investigation.

SaaS additionally relieves your IT faculty of dull and non-esteem-added liabilities, similar to upkeep and overhauls, so they can focus on other business challenges, for example, improving client encounters and planning to utilize new information sources, including those from telematics and outsider suppliers.