Solana is a superior exhibition blockchain known for its lightning-quick exchange rates and potential to scale for mass reception. Marking Solana tokens (SOL) assumes an essential part in tying down the organization and offers the valuable chance to procure automated revenue.

This guide will dig into the mechanics of Solana marking, making sense of the means in question, possible prizes, and significant contemplations. Whether you're a carefully prepared crypto financial backer or new to Solana, this article intends to give an exhaustive comprehension of how to get everything rolling with Solana marking and the advantages it can offer.

Marking Solana (SOL) includes "casting a ballot" for a validator you trust, which adds to the agreement interaction of the Solana organization. At the point when you stake your SOL tokens, you are basically securing them to help the security, respectability, and proficiency of the blockchain.

Read Also: The Ultimate Guide to Insurance Digital Transformation 2024

Solana gets its organization utilizing a blend of Confirmation of-Stake (PoS) and Evidence of-History (PoH) agreement components. Validators assume an imperative part in this cycle by keeping the Solana network running nonconcurrently. By marking SOL tokens assigned to them by clients, validators partake in the agreement and approval of exchanges.

Marking on Solana offers a few advantages for crypto financial backers and members in the organization. Here are a few key benefits:

1: Marking Prizes: As a staker, you have the chance to procure marking rewards in view of how much SOL tokens you have marked. Most of these prizes comprise of shiny new SOL tokens that are naturally conveyed to validators and delegators in light of their stake loads and the organization's expansion rate.

2: Organization Cooperation: By marking SOL tokens, you effectively take part in the Solana organization's agreement system. This assists with getting the organization and keep up with its decentralized nature.

3: Supporting the Biological system: Marking on Solana adds to the development and improvement of the environment. Solana's high exchange throughput and versatility settle on it a well known decision for decentralized application (dApp) improvement, especially in the domain of decentralized finance (DeFi) administrations like loaning, exchanging, and getting.

4: Adaptability and Liquidity: While marking includes securing your SOL tokens for a specific period, Solana gives adaptability by permitting clients to designate their tokens to validators of their decision. This implies that you can decide to assign your stake despite everything keep up with the capacity to move or sell your SOL tokens if necessary.

Read Also: Etihad Airways Engineering collaborates with Ramco Systems

Marking olana permits you to effectively partake in the organization and procure prizes for supporting the biological system's security and agreement process. Similarly as with any venture or monetary choice, taking into account the related dangers and prizes prior to participating in marking exercises on Solana is significant.

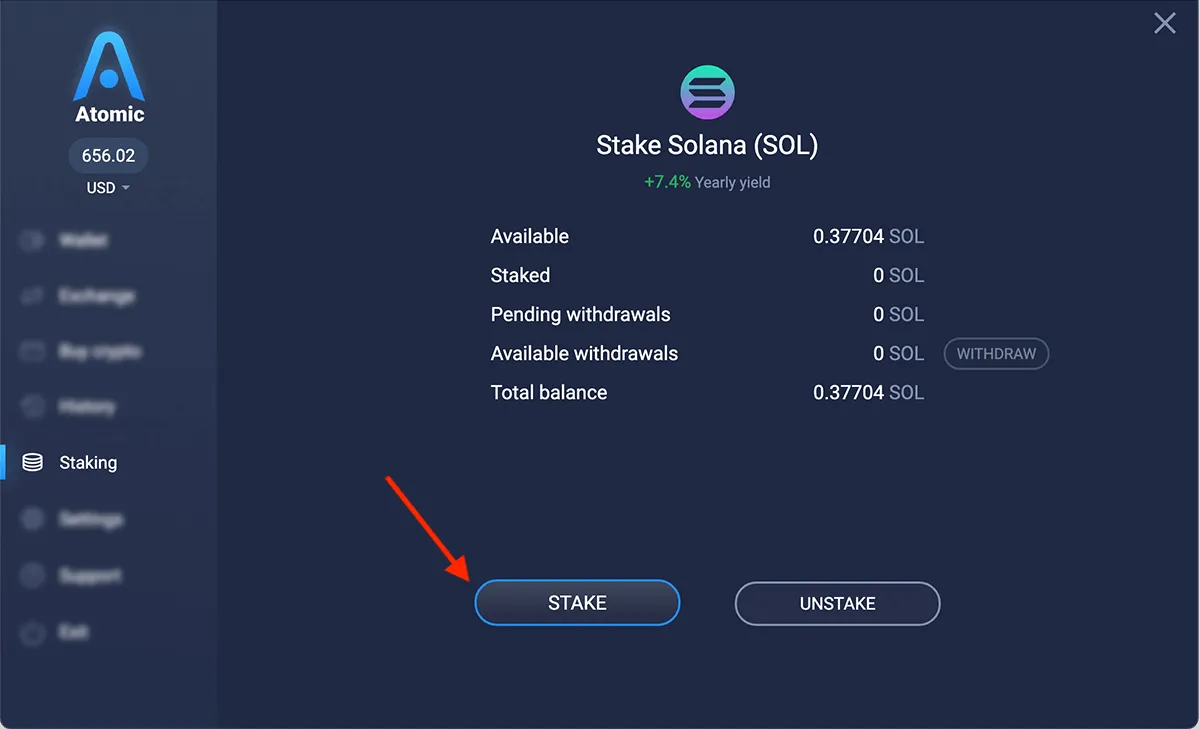

Nuclear Wallet gives a clear method for marking your Solana tokens (SOL) and possibly procure rewards. This is the secret: Find the marking area: Open your Nuclear Wallet and go to the Marking" tab. Select Solana (SOL).

Actually look at the ongoing prizes: Nuclear Wallet shows the ongoing yearly rate yield (APY) for marking Solana, at present at 7% as of composing. This rate can change, so check for refreshes.

Stake your SOL: Enter how much SOL you might want to stake and affirm the exchange. Keep in mind, Nuclear Wallet naturally chooses a validator for you. There's a little organization charge related with marking and unstacking.

Procure rewards: Prizes gather naturally and are compounded into your marked equilibrium, boosting possible profit. Unstaking: In the event that you decide to unstake, explore back to the Solana marking segment and select "Unstake." After an unstaking period (around a couple of days), you'll recapture full control of your SOL and any gathered prizes.

Nuclear Wallet right now just permits you to pick one validator - Nuclear Wallet's. || The 7% APY is dependent on future developments in light of organization conditions.

Marking with Nuclear Wallet offers a helpful approach to procure automated revenue on your SOL property possibly. Continuously recollect, digital money speculations convey gambles, so it's significant to comprehend Solana and the ramifications of marking prior to committing your assets.

Whenever you've set up your stake record and picked a validator on the Solana organization, you can begin procuring prizes through the marking system. Marking Solana (SOL) permits you to "vote" for the validator you trust, and the more votes a validator has, the more weight it has in the agreement cycle. As a prize, you get a marking yield in view of the sum you have marked.

Most of Solana's marking rewards comprise of brand new SOL tokens that are consequently conveyed to validators and delegators in light of their stake loads and the organization expansion rate. The prizes are dispersed among the marked SOL across all validators as per their exhibition and bonus rate.

Solana has a predefined expansion plan that beginnings at 8% each year and will continuously diminishes to 1.5% throughout the following 10 years. As of April 2023, the Solana expansion rate is 6.325%.

This implies that marking rewards are paid out from the expansion, and the appropriation is corresponding to how much SOL marked by every member. To learn What is Inactive Stake Mean on Solana Blockchain?

The typical yearly rate yield (APY) on Solana marking is around 7.41%, as of Walk 2024. The APY addresses the assessed yearly profit from your marked SOL. It's vital to take note of that the APY can vacillate in view of different elements, including network conditions, changes in the expansion rate, and the exhibition of validators.

Reclaiming your marking prizes on the Solana network is a direct interaction. The prizes you procure are naturally added to your stake record, and you can decide to either restake them or pull out them, contingent upon your inclination. What you want to learn more information about What is Inactive Stake Mean on Solana Blockchain?

To pull out your marking rewards, you can start a withdrawal exchange from your stake account. The prizes will be moved to your Solana wallet, where you can oversee them as you see fit. It's essential to take note of that there might be a chilling off period before you can pull out your prizes, which guarantees the solidness and security of the organization.

By partaking in Solana marking, you not just add to the organization's security and decentralization yet additionally acquire awards for your help. Remember that marking includes securing your tokens.

So it's urgent to select a trusted validator and cautiously consider the prizes and expenses related with their administrations. Routinely observing the exhibition of your marking and remaining informed about any updates or changes to the Solana organization can assist you with making the most out of your marking experience.

Whenever you have marked your SOL tokens on the Solana organization, it's vital to comprehend how to really oversee them. In this segment, we will investigate the withdrawal cycle, the chilling off period, and how to deal with lockup periods for your marked SOL tokens.

Pulling out your marked SOL tokens is a clear cycle, however it's critical to take note of that tokens in a Solana stake record must be removed when they are not right now designated. On the off chance that you wish to pull out your tokens, you should undelegate them first.

Read Also: What Are Three Threats to The Future of Global Trade?

When you have undelegated your stake, a "chilling off" period starts. During this period, your tokens are as yet marked and acquiring rewards, however they can't be removed. It requires around 2-3 days for the tokens to complete the process of deactivating and become "idle," so, all in all they are done acquiring marking rewards and can be removed.

After the chilling off period is finished, you can pull out your inert tokens from the stake account. You can decide to send them back to your fundamental wallet address or one more location of your decision. As you want to know What is Inactive Stake Mean on Solana Blockchain?

Staking Solana (SOL) offers a potential chance to acquire automated revenue while supporting the organization's security and decentralization. Understanding the mechanics of marking, expected rewards, and the significance of picking solid validators is critical for an effective encounter. Stages like Nuclear Wallet improve on the marking system, permitting you to take part in getting the Solana network with only a couple of snaps.